Top Credit Union in Cheyenne WY: Trusted Financial Solutions for Your Needs

Top Credit Union in Cheyenne WY: Trusted Financial Solutions for Your Needs

Blog Article

Opening the Conveniences of Credit Unions: Your Guide

In the world of monetary institutions, cooperative credit union stand as a distinct and often underexplored choice for those looking for a more individualized approach to financial. As we delve right into the complexities of lending institution, a globe of opportunities and benefits unravels, providing a peek into a financial landscape where neighborhood values and member-focused solutions take spotlight. From their humble starts to their modern-day impact, recognizing the essence of lending institution could possibly reshape the way you check out and handle your funds.

History of Credit Scores Unions

Credit score unions have an abundant history rooted in the participating motion, dating back to the 19th century. The concept of credit report unions became an action to the monetary needs of individuals that were underserved by typical banks. Friedrich Wilhelm Raiffeisen, a German mayor, is typically credited with founding the initial modern-day lending institution in the mid-1800s (Wyoming Credit Unions). Raiffeisen developed participating financing cultures to help farmers and rural areas access economical credit report and leave the clutches of usurious lenders.

The concept of individuals coming together to merge their resources and supply financial help to each various other spread swiftly throughout Europe and later to The United States and Canada. In 1909, the initial credit score union in the United States was established in New Hampshire, noting the start of a new age in community-focused financial. Ever since, lending institution have actually remained to focus on the financial wellness of their members over profit, symbolizing the cooperative principles of self-help, self-responsibility, freedom, solidarity, equality, and equity.

Membership Eligibility Requirements

Having established a structure rooted in cooperative principles and community-focused banking, debt unions keep specific membership eligibility requirements to make certain placement with their core values and goals. These criteria often revolve around a typical bond shared by prospective members, which could consist of aspects such as geographical area, company, organizational affiliation, or membership in a specific community or association. By needing participants to meet particular eligibility demands, cooperative credit union aim to promote a feeling of belonging and shared function amongst their members, reinforcing the cooperative nature of these economic establishments.

Along with usual bonds, some cooperative credit union may additionally extend subscription qualification to family members of current members or individuals who live in the same home. This inclusivity helps credit rating unions broaden their reach while still staying true to their community-oriented ethos. By preserving clear and clear subscription standards, lending institution can make sure that their participants are actively taken part in supporting the participating values and objectives of the organization.

Financial Services And Products

When taking into consideration the selection of offerings available, credit history unions give a varied array of monetary items and solutions customized to satisfy the special requirements of their members. Participants often benefit from customized client service, as credit score unions prioritize developing strong relationships with those they offer.

In addition, debt unions often offer financial education and learning and counseling to aid participants improve their monetary literacy and make informed decisions. Several cooperative credit union also take part in common branching networks, enabling members to access their accounts at a range of places nationwide. In general, the variety of monetary product or services offered by lending institution underscores their dedication to meeting the varied needs of their participants while prioritizing their financial health.

Advantages Over Typical Financial Institutions

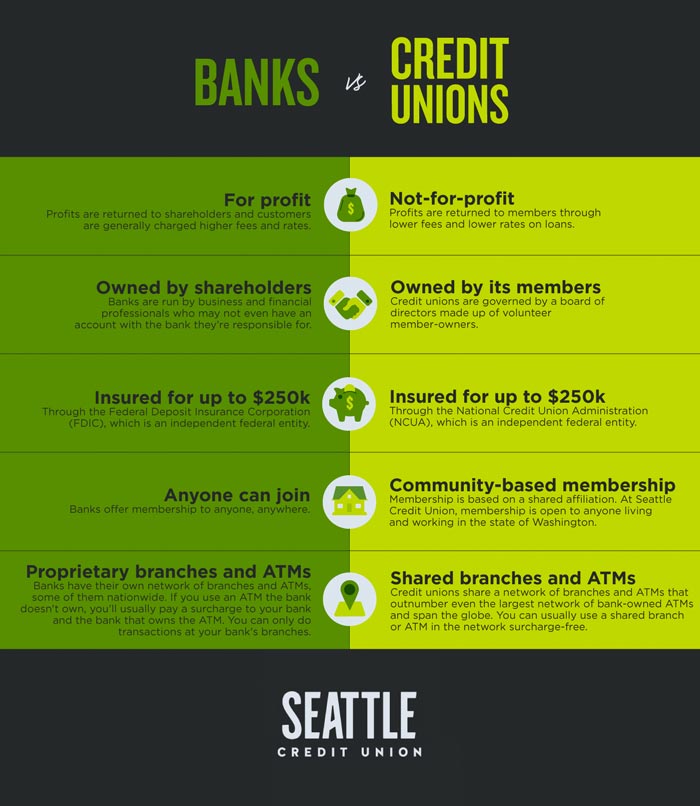

Demonstrating a distinctive method to monetary solutions, lending institution use numerous benefits over typical financial institutions. One crucial advantage is that credit score unions are normally member-owned, suggesting that earnings are reinvested into the company to give much better rates and lower fees for participants. This participating framework frequently results in more customized customer care, as lending institution prioritize member complete satisfaction over taking full advantage of revenues. Furthermore, debt unions are understood for their competitive rate of interest on interest-bearing accounts, car loans, and charge card. This can result in higher returns for participants that conserve or borrow money via the cooperative credit union contrasted to conventional financial institutions.

Furthermore, lending Resources institution often tend to have a strong emphasis on financial education and area support. They usually offer websites sources and workshops to assist participants improve their economic literacy and make sound finance choices (Wyoming Credit Unions). By cultivating a sense of area and shared goals, lending institution can develop a much more encouraging and inclusive financial atmosphere for their participants

Community Participation and Social Effect

By collaborating with these entities, credit history unions can magnify their social impact and address critical issues influencing their neighborhoods. In significance, credit report unions serve as drivers for favorable modification, driving neighborhood advancement and social progress via their energetic involvement and impactful efforts.

Final Thought

In conclusion, lending institution have an abundant history rooted in community and collaboration, offering a diverse variety of economic items and solutions with competitive prices and customized customer go right here support. They prioritize the economic well-being of their members over earnings, promoting a sense of belonging and giving monetary education. By proactively taking part in social effect initiatives, lending institution create a inclusive and helpful financial setting that makes a positive distinction in both individual lives and communities.

Friedrich Wilhelm Raiffeisen, a German mayor, is usually credited with starting the very first modern credit union in the mid-1800s - Credit Union Cheyenne. By needing members to meet particular eligibility demands, credit rating unions aim to cultivate a sense of belonging and shared function among their participants, strengthening the participating nature of these financial institutions

Additionally, debt unions frequently offer financial education and learning and therapy to assist members improve their monetary proficiency and make educated decisions. In general, the variety of economic items and solutions supplied by credit scores unions highlights their dedication to fulfilling the diverse needs of their participants while prioritizing their monetary wellness.

In addition, credit rating unions are recognized for their affordable passion prices on cost savings accounts, fundings, and debt cards.

Report this page